The national minimum wage is increasing, here’s what employers need to know

On 1 April 2022, workers who are on the national living wage (NLW) and national minimum wage (NMW) will receive a pay rise to help with the increase in living expenses. With inflation the highest it has been in a decade at 5.1%, this has big implications for businesses paying their staff.

Employers may see more crackdowns from the HMRC who are working to ensure staff are being paid in line with the minimum wages. Businesses caught out risk being named and shamed for non-compliance – whether intentional or not.

The HMRC can audit a business without any advance notifications, so this means that employers need to make sure they are prepared at any given time. The consequences can be severe – repayments and penalties can be significant. In more extreme cases, non-compliance can lead to criminal prosecution or litigation by employees.

Without effective payroll processes and sophisticated software in place to automate compliance, your business is at risk. As 1 April approaches, we detail how to pay staff in line with the coming increases.

What is the UK minimum wage in 2022?

Here’s a breakdown of what’s increasing from 1 April 2022:

- National living wage – £9.50

- 21-22 year old rate – £9.18

- 18-20 year old rate – £6.83

- 16-17 year old rate – £4.81

- Apprentice rate – £4.81

- Accommodation offset – £8.70

What are national minimum wage considerations?

All of the following can affect an employee’s pay rate, and affect whether or not they are being paid in line with minimum wage.

- Working time: Security searches, handovers, getting changed onsite, and drug/alcohol/Covid-19 tests are all considered working time that needs to be paid and accounted for.

- Unpaid breaks: It’s important to ensure you monitor employees who are working through unpaid breaks, as this counts as working time that they should be paid for.

- Salary sacrifice: You must ensure contributions don’t take average hourly pay below the minimum wage.

- Travel schemes: If an employer offers discounted travel cards for employees and deducts the cost of the card from employees’ pay overtime, they must ensure these deductions aren’t reducing pay below the minimum wage.

- Uniform: If an employee supplies any part of their uniform, the cost of purchasing this will be deducted from their pay when calculating whether an employee has been paid in line with the national minimum wage.

- Salaried employees: Because there are exactly 52.14 weeks in a year, rather than the commonly assumed 52, employers need to look at pay received and the hours worked over the entire 52.14 weeks, and average them out to ensure they are meeting minimum wage requirements.

- Record-keeping: Employers must maintain 6 years of records as evidence that the national minimum wage has been paid, including keeping records of timesheets and payslips. The onus is on employers to maintain this record, and it will be presumed employees have not been paid national minimum wage unless proven otherwise.

How do I ensure national minimum wage compliance?

Outsourcing payroll to an experienced provider can make the world of difference when it comes to compliance. When payroll teams are already overstretched, staying on top of legislative change creates additional risk – and Roubler’s outsourced payroll team helps mitigate this. Our local payroll service provides UK businesses with qualified professionals who help lift the burden of responsibility from the shoulders of in-house teams.

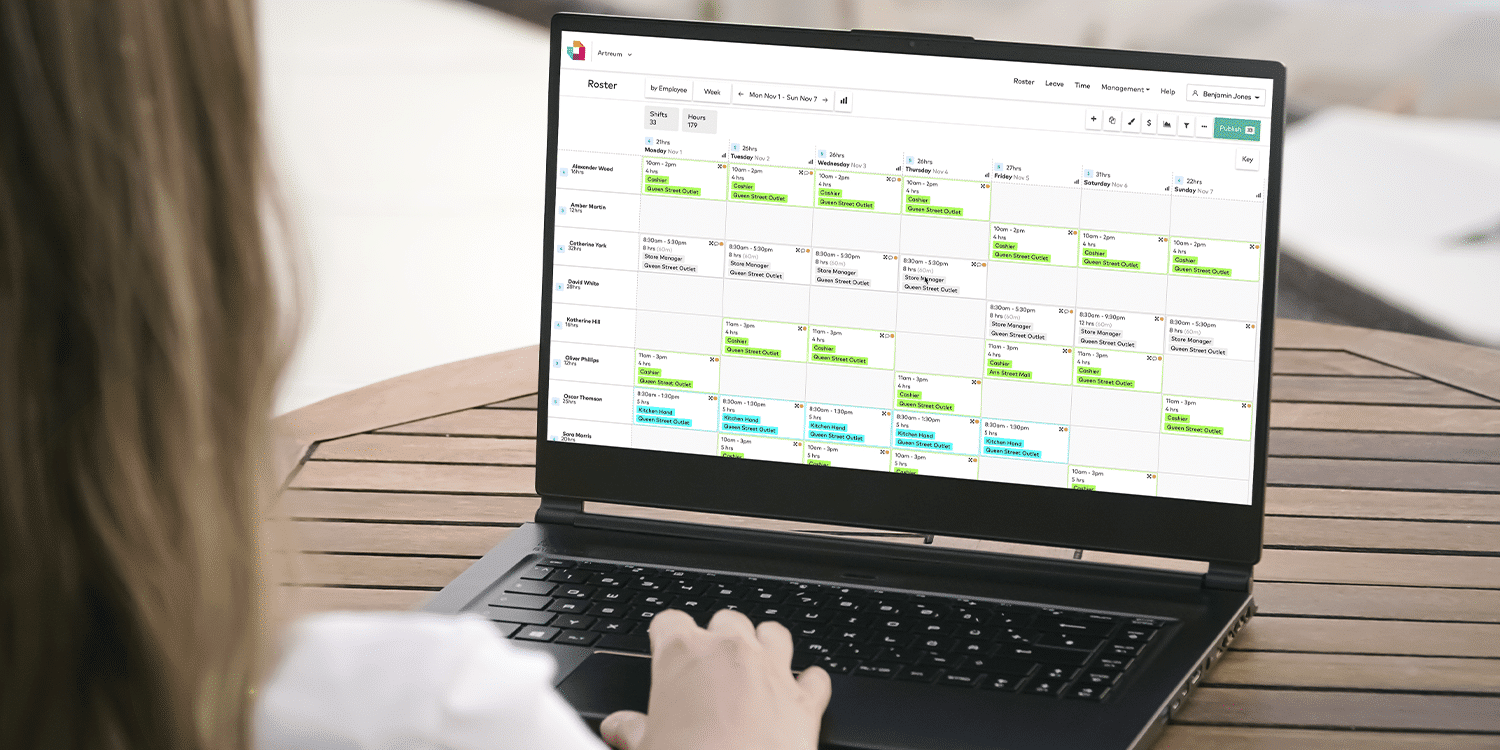

Having the right systems in place is also key. With Roubler’s software, managers will be alerted if an employee’s hourly rate of pay according to their age is below the national minimum wage. Managers will also be prompted to review employees’ pay rates when they have an upcoming birthday.

Roubler can be configured according to whether an employee is eligible for or exempt from minimum wage requirements, and will accurately calculate wages and deductions based on built-in pay rules that have been configured specifically for this purpose.

All-in-one workforce management software also means there is one source of truth, which creates less room for error. Another benefit is comprehensive audit trails, making it easy to provide accurate time and attendance and payroll records.

If you are an existing customer and would like to learn more about Roubler’s outsourced payroll service, please speak with your customer success manager. If you are not currently a Roubler customer and would like to find out more, then please contact us today.