Single Touch Payroll reporting made simple

Gain peace of mind that your payroll complies with Single Touch Payroll (STP) phase 2 reporting requirements.

What is Single Touch Payroll?

Single Touch Payroll is the way in which all Australian businesses

must report their super contributions and PAYG to the Australian

Taxation Office (ATO).

Businesses have been required to submit payroll information to the ATO each time they process their payroll. This includes current total year-to-date wages and tax, and current total super contributions.

Single Touch Payroll Phase 2

STP Phase 2 is the next stage in streamlining the way reporting obligations for payer and payee, removing the need for manual reporting to multiple government agencies.

There’s more information that you’ll need to provide but the way employers manage STP won’t change.

Be prepared for Single Touch Payroll Phase 2

Single Touch Payroll Phase 2 will introduce a more intricate reporting system unlike phase 1. You can rely on Roubler to help ensure your payroll remains STP Phase 2 compliant.

Roubler will be ready for phase 2 changes come January 2022. Gain peace of mind knowing our seamless payroll software will be up-to-date with reporting features to help you remain compliant.

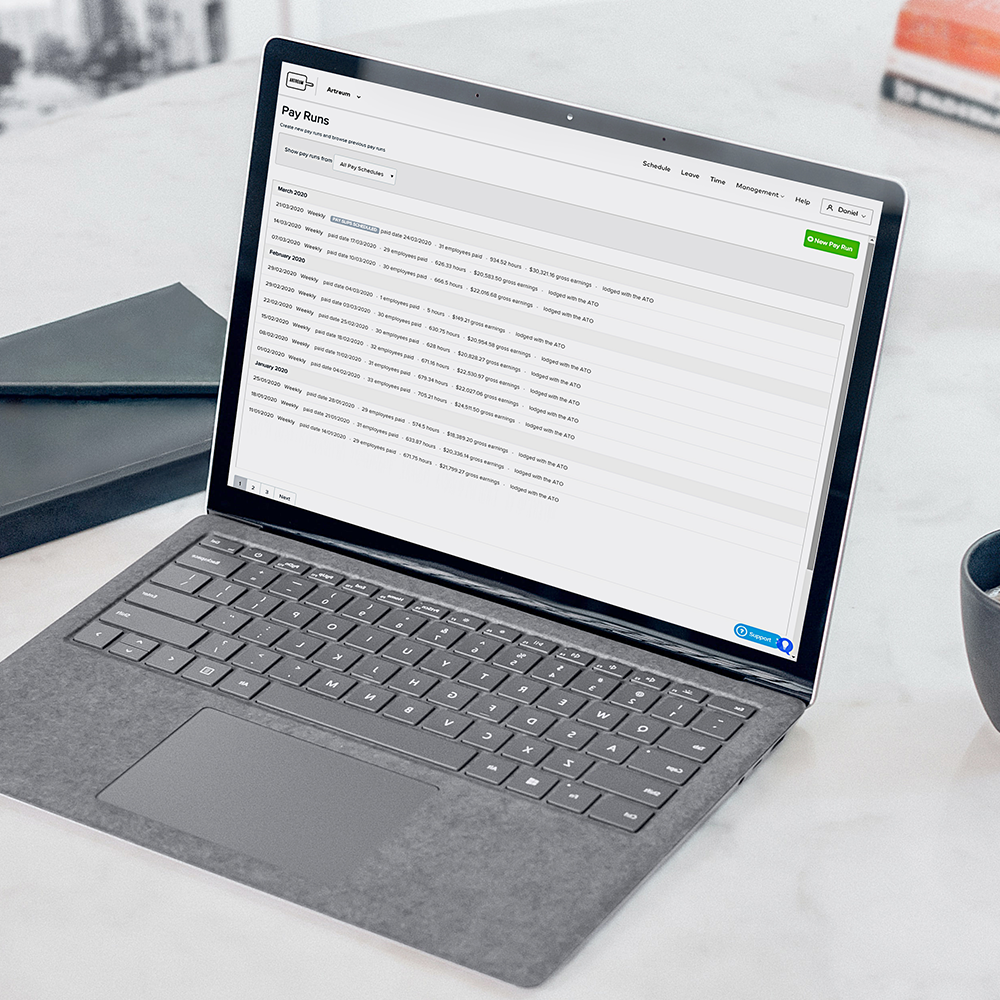

Streamlined payroll processes

A Single Touch Payroll provider like Roubler will help streamline the entire process by enabling you to submit your payroll reporting directly to the ATO each month, rather than having to do this manually.

What does Single Touch Payroll mean for your business?

Keeping your business compliant with these reporting standards is crucial

to avoiding penalties.

The easiest way to ensure your business adheres to Single Touch Payroll requirements is to implement an appropriate payroll software system.

If you aren’t already outsourcing your payroll to a reliable payroll provider, now could be a good time to consider this.

Regulatory compliance

and penalties

Single Touch Payroll reporting standards have been introduced to encourage transparency and compliance among Australian businesses. The ATO now has access to all payroll details, and as a result, can easily identify non-compliant businesses.

Failure to meet the Single Touch Payroll reporting requirements will attract penalties. Roubler’s payroll software and outsourced payroll service are compliant with Single Touch Payroll reporting regulations.

Get Single Touch Payroll

compliant today

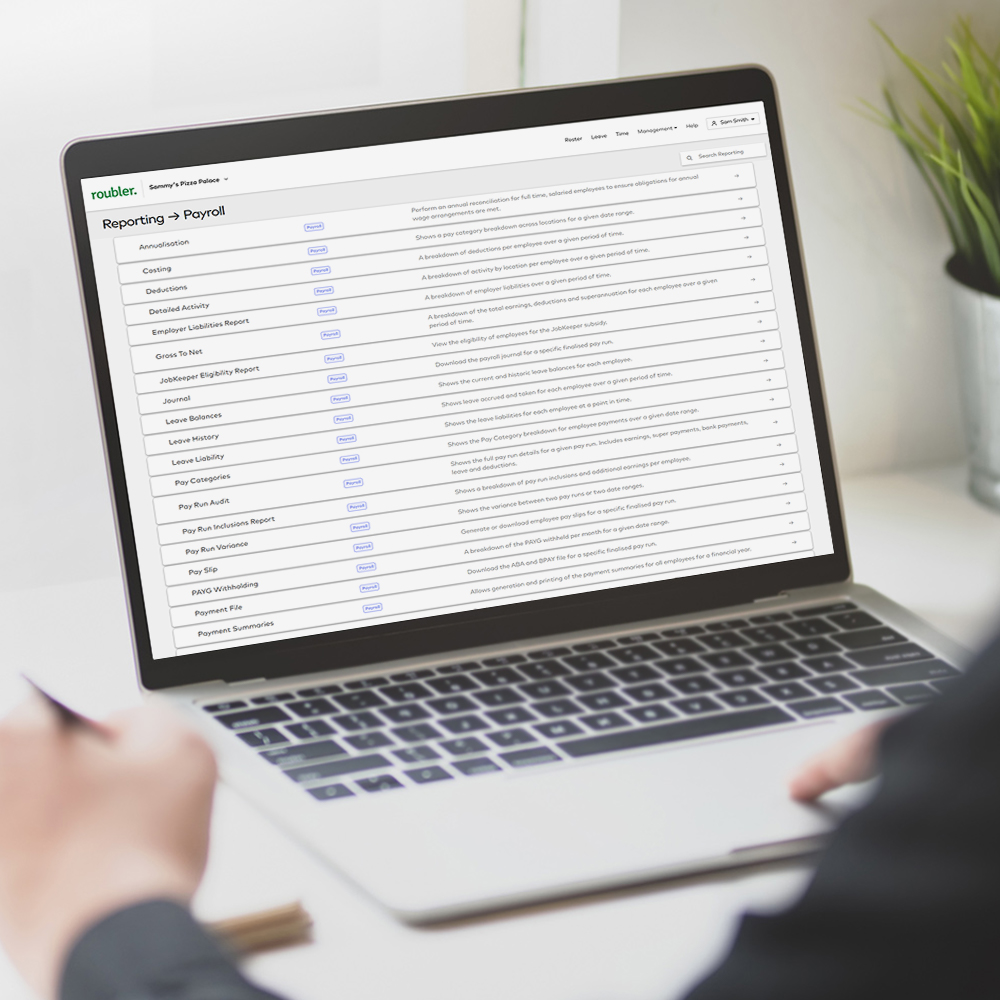

Roubler’s software includes Single Touch Payroll functionality to make

it easy for you to claim the JobKeeper incentives and meet your

reporting requirements.

For each payslip generated, Roubler will send the PAYG and super contribution details to the ATO on your behalf.

This will help your employees access all their payment details via the ATO’s online portal, and you can rest assured that your business’ payroll records have been handled in line with the latest regulations.

Discover our simply seamless workforce managementemployee onboardingrosteringtime and attendanceemployee self serviceleave managementpayrolldocument librarybusiness intelligenceoutsourced payrollsupportworkforce management system

Onshore payroll team

Our Australian payroll team has more than 15 years’ experience processing payroll in Australia’s complex regulatory climate. As a result, they are well equipped to manage the changes and challenges presented by Single Touch Payroll reporting requirements. Our team is always available to answer any queries you have about Single Touch Payroll reporting requirements.

Simplified STP reporting

Banish end-of-financial year stress in your business with our simplified reporting. Roubler’s Single Touch Payroll software will keep accurate records of all details submitted to the ATO. You’ll be able to edit these values if required.

STP phase 2

Roubler has already taken the required steps to update its software to be ready for Single Touch Payroll phase 2 capability.

The ATO are releasing more information regarding software in the coming weeks, and Roubler will incorporate this information accordingly to ensure that all of our clients pay runs are completely in compliance with regulations.